Contents:

You need to now choose the Account that you are reconciling currently and hit the OK tab. Writes like a traditionalist but with the sophistication of a modernist. He prefers to write articles that are smooth from start to finish, making sure to include all of the nuances of the subject matter. While writing, he prefers to incorporate a variety of words that best enhance vocabulary and content while also making his work readable to the general public. Given his experience, he is well-suited to write on virtually any topic. Alphabet that you find written right above the transaction.

For instance, the wrong balance displays on the account. In this training, I’ll show you what to do when the beginning balance on your bank statement and QuickBooks don’t match. If you’re unable to resolve the reconciliation issues on your own, don’t hesitate to reach out to QuickBooks Support for assistance. They can help you troubleshoot the issue and get your accounts back on track.

Attorney reprimanded for accounting issues, changes program … – Brattleboro Reformer

Attorney reprimanded for accounting issues, changes program ….

Posted: Thu, 03 Feb 2022 08:00:00 GMT [source]

Accounting software, there are two different processes you can follow to undo reconciliation. This article focuses primarily on the process that non-accountant users will use to undo reconciliation in QuickBooks Online. A transaction that took place years ago was deleted or changed then you have to undo the bank reconciliation of that previous year. The difference of your reconciled total amount and beginning balance is caused by an edited or deleted reconciled transaction. Let me guide you on how to identify the transaction so you can fix this issue.

How to Easily Find and Fix Bank Reconciliation Discrepancies

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Even then, you’ll likely only reconcile non-bank accounts once a year, as in an inventory reconciliation. You’ll get a warning that your account isn’t ready to reconcile because your beginning balance is off by the amount of the transaction or transactions you un-reconciled.

- If you see any inaccurate adjustments that are affecting the account balance, inform the person who made the changes.

- Incorrectly entering either one of them can cause the error of QuickBooks Online reconciliation discrepancy in the report.

- Accounting software, there are two different processes you can follow to undo reconciliation.

Here’s how to find and fix https://bookkeeping-reviews.com/ so you can finish reconciling. Complete the bank reconciliation making sure that the total deposits and total withdrawals match the amounts on the bank statement. In my opinion, as a business owner, the accounting department is one of the most crucial sectors in a business. They are the ones managing the funds for the company.

Reasons for undoing a reconciliation in QuickBooks Online

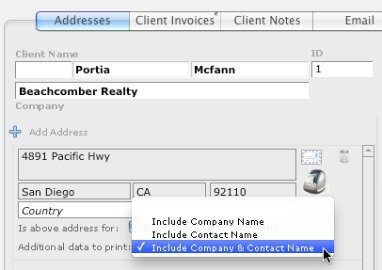

Check if you have got a copy of your bank or credit card statement. If you have multiple changes affecting your beginning balance, you will address each one using the same method. If a transaction was accidentally marked as reconciled, you will locate the transaction and change the box from “R” to blank and save.

Non-accountant users can undo the reconciliation status of individual transactions. Accountant users can undo an entire reconciliation; so if you’re working with an accounting professional, contact them if you need to undo entire reconciliations. If this is the first time you’re reconciling this account,correct the opening balancefor the account. Verify that all transactions on your statement have been matched to QuickBooks. Add any transactions that are missing from QuickBooks by clicking the green Finish later button and entering the transactions as normal. The sum of the cleared transactions—which are selected using the radial button —is reflected in payments + deposits .

Step 3 – Fill in Statement Information

In this writing piece, we have included responses of leaders from different organizations sharing QuickBooks bank account reconciliation issues they face. Let’s read and learn what solutions they suggest. Then move on to Step 2 to Fix beginning balance issues if you’ve reconciled the account in the past QuickBooks Online. The opening balance is the starting point for an account.

Make corrections after you remit (pay) – Canada.ca

Make corrections after you remit (pay).

Posted: Mon, 14 Dec 2020 08:00:00 GMT [source]

When your QuickBooks account is reconciled, it may show you a different balance at the time of checking the upcoming reconciliation. This is known as the reconciliation discrepancy error in QuickBooks. A forced former reconciliation might cause discrepancy which results in reconciliation adjustment. To resolve this issue, you will have to check the reconciliation discrepancy account for determining inappropriate changes. Also you can learn full process QuickBooks Reconciliation Discrepancy Adjustment which helps you . Clicking on the blue “We can help you fix it” will allow you to see reconciled transactions that were changed after the prior reconciliation was completed.

Steps to Resolve the Reconciliation Discrepancy issue in QuickBooks Desktop

You may also need to troubleshoot your company file for damaged transactions. To find the reconciliation discrepancies, you should review the opening and beginning balances. Later, you can combine multiple transactions into one. After keeping the correct transactions aside, you can enter the missing transaction in QuickBooks. Once done, you can remove the transactions not available on the bank statement and review the transactions to clear the discrepancies. When you receive a bank statement, it should match with your bank transactions.

You can also read another informative post relating to this accounting software. See what the QuickBooks error 1935 is and when it can show up on your system. There may be a change in a former reconciled transaction.

Menu

This issue usually occurs more with checks than with other forms of transactions. Fully reconciled and matching transactions mean that everything is matching in the bank and books statements, with only uncleared Open Checks coming as a difference. QuickBooks Online Bank Reconciliation is a task with which you can match your QuickBooks transactions to ensure everything is in line. Reconciling your accounts is an essential accounting task. This is a checks-and-balances measure that lets you verify the accuracy of your accounting records. When done correctly, it also helps you prevent fraud in your business.

You may also have entered a vendor’s name, category, or date wrong and only detect the mistake after reconciliation. You can change some of this information without redoing the entire reconciliation , but if you want your records to be 100% accurate, it’s worth going through the effort. Changing the source account of a previously reconciled transaction. Follow the steps given below to carry out the Reconciliation Process and keep your bank statement handy to solve the Bank Reconciliation problems.

Avail of the support services offered by us and leverage the unprecedented changes. We have the most viable and reliable solutions to all your accounting-related problems and other accounting issues. The next step is to Review the report and look for any transactions that have been entered on the report that isn’t on the bank statement. It is suggested that the users should reconcile the bank/credit card accounts within QuickBooks regularly to ensure that the results are accurate. If a transaction that took place years ago was changed or removed lately, you may have to undo bank reconciliations for the previous years. Read and review the report for transactions that mismatch with your bank statement.

QBS is a top notch business accounting & finance consulting firm. We are a hub of technocrats who cater the best quality support services. Our experts & certified professionals work with an aim to cater utmost satisfaction to our clients. Start off by checking the opening and balances and ensuring that they are all correctly entered. Some edited or deleted transactions that were already reconciled.

This report provides a list of transactions that were changed since the last reconciliation. You may have voided, deleted, or changed the amount of a previously cleared transaction since your last reconciliation. When you open the Begin Reconciliation window and select an account to reconcile, the opening balance displayed doesn’t match the ending balance from your previous reconciliation. You should review this section every month to make sure these uncleared transactions make sense. When you’ve entered all the information from your bank statement, click the green Start reconciling button to continue.

After matching the transactions, it should become zero. However, some users fail to reconcile the transactions or match the difference. If you are also experiencing a QuickBooks reconciliation discrepancy then you should fix it. Thus, we bring you this guide where you will learn how to fix reconciliation discrepancies in QuickBooks Online and Desktop.

Once your opening loan amortization is accurate, you can continue with the reconciliation of the present month. In case you encounter an inaccurate balance sheet for any month, then you will have to fix it. If you can’t discover the transactions that require to be modified to make it perfect then have to undo the former reconciliation until the opening balance is precise. Begin reconciling again once you know you have the right beginning balance.