Contents:

HSA savings are tax exempt, as is the interest or earnings they generate, and any distribution for qualified medical reasons are tax free as well. The Fed continuing to aggressively raise rates will be its biggest growth driver. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Sign in to your free account to enjoy all that MarketBeat has to offer.

And while account growth has been strong over the past decade, there is still a trend towards companies switching to high-deductible plans. There are somewhere around million HSA accounts, and HQY sees the market maturing at around 60 million. The company generates revenue from service, custodial, and interchange fees. Service fees are paid by clients on a per month per account basis, while HQY also makes interchange fees when a member makes a payment using its payment card or virtual payment system. My No. 1 dividend stock for a LIFETIME of income.Few people realize this… But dividends account for up to 90% of the stock market’s returns over the past century! I think it’s a crying shame folks don’t know how powerful dividends are.

WageWorks Inc. said Tuesday it has received an unsolicited letter of interest from Mansa Parent Corp. that values the company at $58.58 a share. The company said its board has reviewed the letter and unanimously conclude… Storylines Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era. This documentary-style series follows investigative journalists as they uncover the truth. Live from Hong Kong, bringing you the most important global business and breaking markets news information as it happens. The Zacks Equity Research reports, or ZER for short, are our in-house, independently produced research reports.

The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. Expect a strong Q4 when the company reports earnings later this month. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 . This is a lower news sentiment than the 0.59 average news sentiment score of Medical companies.

HealthEquity witnesses solid growth in HSAs besides recording robust performances in all its segments in the third quarter of fiscal 2023. Sign Up NowGet this delivered to your inbox, and more info about our products and services. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

RATIOS/PROFITABILITY

Natera NTRA, another stock in the same industry, closed the last trading session 2.3% higher at $56.43. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Represents the company’s profit divided by the outstanding shares of its common stock.

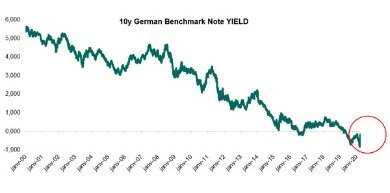

- Some of that is due to HQY locking in some rates via a laddering strategy and members moving some money into investments.

- Live from Hong Kong, bringing you the most important global business and breaking markets news information as it happens.

- This provider of services for managing health care accounts is expected to post quarterly earnings of $0.34 per share in its upcoming report, which represents a year-over-year change of +70%.

- Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price.

- The Zacks Equity Research reports, or ZER for short, are our in-house, independently produced research reports.

It also provides mutual fund investment platform; and online-only automated investment advisory services through … At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year. These returns cover a period from January 1, 1988 through February 6, 2023.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

The “King Of Quants” sees 10X potential…Eric Fry believes he just discovered America’s next “Wealth Supercluster” and it’s forming in the place you’d least expect. Investors are already flocking there for a chance at 1,000%+ returns. P/B Ratios below the best day trading stocks 3 indicates that a company is reasonably valued with respect to its assets and liabilities. Only 2 people have added HealthEquity to their MarketBeat watchlist in the last 30 days. 13 people have searched for HQY on MarketBeat in the last 30 days.

359 employees have rated HealthEquity Chief Executive Officer Jon Kessler on Glassdoor.com. Jon Kessler has an approval rating of 95% among the company’s employees. This puts Jon Kessler in the top 30% of approval ratings compared to other CEOs of publicly-traded companies.

HealthEquity downgraded to outperform from strong buy at Raymond James

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. 10 brokers have issued twelve-month price targets for HealthEquity’s stock. On average, they expect the company’s share price to reach $80.62 in the next year. This suggests a possible upside of 37.2% from the stock’s current price.

Credit Suisse AG sells 249,962 HealthEquity, Inc. shares (NASDAQ … – Best Stocks

Credit Suisse AG sells 249,962 HealthEquity, Inc. shares (NASDAQ ….

Posted: Sun, 19 Feb 2023 08:00:00 GMT [source]

That said, according to HQY, the average HSA balance is only $3,000 per participants, so there is a lot of potential upside for balance to grow. The company is scheduled to release its next quarterly earnings announcement on Tuesday, March 21st 2023. High institutional ownership can be a signal of strong market trust in this company. HealthEquity has only been the subject of 2 research reports in the past 90 days.

Private Companies

The company put out FY2024 revenue guidance already when it reported Q3 results, but it assumed an HSA cash yield of only 2.25%. For its part, HQY is the HSA market leader with over 8 million accounts and $22 billion in assets under custodianship. It’s done a good job of driving sales through its channel partners recently, with 75% of net new logos coming through partners. Its acquisition of WageWorks also helped give it full suite of employee benefit options to offer as well as cross-sell. Real-time analyst ratings, insider transactions, earnings data, and more.

Its technology allows customers to see their tax-advantaged healthcare savings, compare treatment options and pricing, pay healthcare bills, receive benefit information, and earn wellness incentives. The firm primarily partners with health plans and employers and serves as the custodian of its customers’ health savings accounts . HealthEquity also engages in reimbursement arrangements and offers healthcare incentives to its members. In addition, the company provides investment advisory services to customers whose account balances exceed a certain threshold.

Financials

CompareHQY’s historical performanceagainst its industry peers and the overall market. TipRanks has tracked 36,000 company insiders and found that a few of them are better than others when it comes to timing their transactions. See which 3 stocks are most likely to make moves following https://day-trading.info/ their insider activities. I have no business relationship with any company whose stock is mentioned in this article. HQY is set to greatly benefit from higher interest rates, and whether that is in fiscal 2024 or later due to laddering rates, it’s still going to be a nice tailwind.

The company’s average rating score is 2.80, and is based on 8 buy ratings, 2 hold ratings, and no sell ratings. When it comes to the year-to-date metrics, the HealthEquity Inc. recorded performance in the market was -14.93%, having the revenues showcasing -18.89% on a quarterly basis in comparison with the same period year before. At the time of this writing, the total market value of the company is set at 4.78B, as it employees total of 3688 workers. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. It’s packed with all of the company’s key stats and salient decision making information. Including the Zacks Rank, Zacks Industry Rank, Style Scores, the Price, Consensus & Surprise chart, graphical estimate analysis and how a stocks stacks up to its peers.

Presently, HealthEquity Inc. shares are logging -33.79% during the 52-week period from high price, and 2.62% higher than the lowest price point for the same timeframe. The stock’s price range for the 52-week period managed to maintain the performance between $51.10 and $79.20. HealthEquity witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn’t suggest further strength down the… According to 17 analysts, the average rating for HQY stock is “Buy.” The 12-month stock price forecast is $83.88, which is an increase of 42.17% from the latest price.

This represents a change of +19.3% from what the company reported a year ago. HealthEquity HQY shares ended the last trading session 10% higher at $57.70. The jump came on an impressive volume with a higher-than-average number of shares changing hands in the session. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Based on the recent corporate insider activity of 46 insiders, corporate insider sentiment is negative on the stock.

Kayne Anderson Rudnick Investment Management LLC Boosts … – MarketBeat

Kayne Anderson Rudnick Investment Management LLC Boosts ….

Posted: Wed, 15 Mar 2023 11:26:12 GMT [source]

View analysts price targets for HQY or view top-rated stocks among Wall Street analysts. Total Debt to Equity Ratio (D/E) can also provide valuable insight into the company’s financial health and market status. The debt to equity ratio can be calculated by dividing the present total liabilities of a company by shareholders’ equity. HQY manages employee consumer direct benefits, including health savings accounts , flexible spending accounts and health reimbursement arrangements HRAs), as well as other benefits such as COBRA and commuter benefits. As part of its services, it offers telemedicine, wellness incentives, healthcare bill evaluation, payment processing services, and treatment option and comparative pricing information. Let’s take a glance in the erstwhile performances of HealthEquity Inc., multiple moving trends are noted.

In the past three months, HealthEquity insiders have not sold or bought any company stock. MarketBeat has tracked 6 news articles for HealthEquity this week, compared to 4 articles on an average week. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. HealthEquity possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. There may be delays, omissions, or inaccuracies in the Information.

Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends.