Contents:

Many of the courses are paired with webcasts and other events, including live classroom instruction at a local TD Ameritrade office. While you do need to open a TD Ameritrade account to access its education center, you’re not required to make a minimum investment. So, when you’ve learned enough to begin, your trading account is set up and ready to go. Udemy offers a wide range of beginner stock trading courses at remarkably low prices, making it our choice as the best course provider for newbies.

New investors who are looking for a hands-on learning experience will find that paperMoney is a powerful tool. The value of keeping track of your ideas and journaling which trades you make is widely recognized as key by successful traders. Fidelity’s notebook feature allows you to jot down ideas about stocks in one place, which are handily displayed in a list along with the current stock price. Third-party research reports from Argus Analyst, Investars and many more are available within the client portal. Stock market beginners can take advantage of the screener section to research potential investments.

With that foundation of knowledge, you can move up to The Complete Foundation Stock Trading Course, available for $179.99 with steep discounts again available. Following that, you’ll take the Swing Trading course, featuring over six hours of content on swing trading methodology and strategy. You’ll learn the foundations of swing trading, along with advanced technical analysis, how to analyze long and short-chart patterns, and how to identify key price levels. For example, each options contract traded on Fidelity, Schwab and Merrill Edge costs $0.65, whereas Robinhood and Webull allow options contract trades for free. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Interactive Brokers – Best for Active Traders (Desktop)

TD Ameritrade is one of the most popular brokers in the world, and for good reason. The platform is a great fit for investors who want a well-rounded brokerage experience, great customer support, and lots of account and investment options. TD Ameritrade has excellent educational resources for beginners, several trading platforms for investors of all skill levels, and pretty much every type of brokerage account you can think of. The Simple Dollar has partnerships with issuers including, but not limited to, Capital One, Chase & Discover. SogoTrade is one of the quieter online stock brokers and unless you’ve already opened an account with them, this may be the first time you’ve heard of them.

We know everyone’s financial circumstances and goals are different, so we’ve chosen a variety of brokers to help you find one that meets your needs. Here’s a review of our picks for the best online brokerages for beginners. Follow Fox on Twitter at@IBD_RFox for more on the best online brokers for beginners and market insight. Other brokers that ranked high in their mobile trading platform included Fidelity and E-Trade.

Best for Day Traders

Please note that markups and markdowns may affect the total cost of the transaction and the total, or “effective,” yield of your investment. Opening a brokerage account isn’t much more complicated than opening a bank account, but it can take its due share of research. Thieves have become adept at duplicating official-looking documentation from different financial institutions. You can receive a convincing-looking email from what looks like your online broker. But it’s really just a copy, directing you to log into your account by clicking a link. It goes to a duplicate webpage that’s designed to collect your passcodes.

Interactive Brokers comes with a solid research offering and educational resources that include how-to articles, webinars and a training course. You can get questions answered over the phone or through a chat system 24 hours a day Monday through Friday, as well as on Sunday from 1 p.m. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Minimum balances and private broker fees are also something to take into consideration when making your decision. High fees might be worth it if they are accompanied by personalized service that helps you meet your investment goals. There is certainly no shortage of investment options, but the differences amongst them is vast. The kind of returns you can expect from a bond fund versus equities are very different, as are their time horizons. Options and crypto might be considered more volatile assets than bonds but can also offer higher returns.

Financial Edge

That said, there are bonds that can hold higher risk as well, meaning that it’s crucial to know exactly what you’re investing in as there’s no one umbrella strategy for any asset allocation. Fidelity may be the most investor-friendly broker out there, making it a top choice for beginners. This broker offers it all and does it at a high level, with remarkable customer service, too, especially by phone, where you can get an answer to your detailed question in seconds.

- Steven Hatzakis is the Global Director of Research for ForexBrokers.com.

- None of the ten brokers listed here require minimum balances or charge inactivity fees.

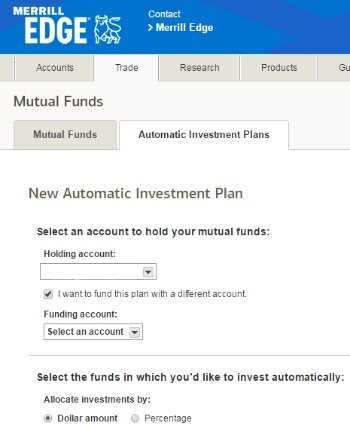

- Merrill Edgeis the online platform of a full-service broker, Merrill Lynch.

- Is its portfolio experience, which is managed using an interface called Pies.

- Recommended for investors buying stocks, options & ETFs directly from charts using the award-winning TC2000.

Look for a https://trading-market.org/ that can assist you with quality research and educational materials to aid your development as an investor and help you make winning decisions in the markets. We recommend that every individual do their own research to determine which online brokerage might best suit them. You can even follow the trading activity of founder Tom Sosnoff, who was a floor trader at the Chicago Board Options Exchange early in his career.

The fees are also pretty reasonable considering it is for any stock transaction and there are no maintenance fees. With a Fidelity trading account, you can sell and buy stocks, mutual funds, and other securities. It also provides charts where you can observe the performance of your investments over time to see if you need to reassess or they are effective. An online brokerage account is a portfolio of cash and securities on an online trading platform.

Webcasts with real-time analysis take place twice a week, providing users with a better understanding of the markets. The Knowledge section within the client portal includes guided overviews, articles and videos covering topics such as the basics of stock selection. Chat and email support were also reliable in our survey, with fast, helpful responses. For those seeking more human interaction, Fidelity serves its customers through 12 regional offices and more than 190 investor centers in the United States. Unlike some other brokers, users must navigate an automated menu when calling support. In addition, for individuals who prefer the one-on-one experience with a consultant, Schwab offers an extensive branch network across the United States.

Investors Underground

Many financial institutions make two-factor authentication available to you. It requires you to enter a verification code after entering your passcodes. Your trading app will send you the code by either email or text, and you then type that code to gain access to your online account. Ally Invest gives investors the option of self-directed trading, robo portfolios that automatically adjust your portfolio in accordance with your goals, and wealth management by a human advisor. This advertisement contains information and materials provided by Robinhood Financial LLC and its affiliates (“Robinhood”) and Publisher, a third party not affiliated with Robinhood.

Optum Health Leadership Team – Optum

Optum Health Leadership Team.

Posted: Tue, 29 Nov 2022 15:54:37 GMT [source]

One standout product for new and passive investors is Schwab Intelligent Portfolios. This no-fee robo-advising platform handles your investments for you based on your investment profile and goals. It’s also noteworthy for offering both basic and professional-level trading platforms.

Investors can use online brokers instead of conventional financial advisors to buy and sell stocks, bonds, mutual funds, ETFs, options and other assets. Online brokers still charge fees despite a common no-commission structure. Interactive Brokers was primarily designed for active traders, but the online stock broker recently launched the IBKR Lite platform that’s geared toward beginning investors.

Just How Common Is Corporate Fraud? – The New York Times

Just How Common Is Corporate Fraud?.

Posted: Sat, 14 Jan 2023 08:00:00 GMT [source]

Our broker reviews were conducted by a seasoned market professional with over 20 years of experience in the markets, both as a broker and a retail investor. Charles Schwabcombines competitive fees, a powerful platform and high-quality research and educational materials. A close contender for winning best brokers for beginners, Schwab outshone its rivals in the area of customer service. Using the screener tool for mutual funds, users can search thousands of funds, including Fidelity’s own fee-free funds and those with low minimum investment requirements. Similarly, the ETF screener tool allows users to scan over 2,000 commission-free ETFs based on their interests.

Segment the best online stock brokerss you’re watching with these exceptional stock screeners. Let’s take a look at some of our favorite stock screeners for traders of all skill levels. I hope to watch the videos that was part of the 7-part video package I received also when I signed up when I am traveling this week! Hi Tim, just started your 30 day bootcamp, and I would like to know your recommendations for brokers in Canada? You can always try out different brokers like I have over the years. I started your 30-day bootcamp today, and I am looking forward to being a millionaire success story.

Some may value having robust research tools, whereas others want access to option trading. For beginning investors, criteria such as strong customer service and educational resources might be a high priority. Since its founding in 2016, the Bear Bull Traders online community has become one of the more popular among active day traders. Besides its vast library of educational resources, Bear Bull Traders provides members with ongoing support through member meetups and its crew of chat room monitors. Members can access the trade simulator for about $100 per month to hone their skills with paper trading before going live with their own money at stake. However, the learning curve for becoming a successful stock trader can be very steep.